Dual Defense Portfolio Command Center

Last trade signal: 01/31/2026

Last Altruist scheduled rebalance: 01/01/2026

Next Altruist scheduled rebalance: 02/02/2026

Total New Trades: P1 (2) | P2a (5) | P2b (2*) | P3 (6) | P4 (9)

-

Position 1: Canopy HYCC Income

GLDI - UBS Gold Shares Covered Call ETN

Position 2: Canopy DIVFUND Rotation

IDV - iShares Int’l Select Dividend ETF

Position 3: Bond Buddies

ORNAX - Invesco Municipal Opportunity

Position 4: Canopy Convertible Income

(NEW) ACV - Virtus Diversified Income & Convertible

Position 5: Bonds iShares

FALN - iShares Fallen Angels USD Bond ETF

Position 6: Gold’n Yield

(NEW) IHYF - Invesco High-Yield Bond Factor ETF

Position 7: Treasuries

TLH - iShares 10-20 Year Treasury Bond ETF

Position 8: Bonds NPF

(NEW) PHB - Invesco Hi Yld Corp Bond ETF

Position 9: Bonds SPDR

JNK - SPDR High Yield Bond ETF

Position 10: Buffet Backstop

BRK.B - Berkshire Hathaway-B

Position 11: Canopy Defensive Equity ETF

QEFA - SPDR MSCI EAFE Strategic Factors ETF

-

Positions 1-8 collectively known as: EZ-RO Sector Rotation Index

Position 1: SPDR Sectors DD

(NEW) XLV - Health Care Select Sector SPDR ETF

Position 2: SPDR Subsectors

XPH - SPDR S&P Pharmaceuticals ETF

Position 3: iShares Sectors

(NEW) XPH - SPDR S&P Pharmaceuticals ETF

Position 4: iShares Subsectors

IHE - iShares US Pharmaceuticals ETF

Position 5: Vanguard Sectors

(NEW) VHT - Vanguard Health Care ETF

Position 6: Dissimilar Sectors DD

PJP -Invesco Pharmaceuticals ETF

Position 7: Global Prudence DD

(NEW) EEM - iShares MSCI Emerging Markets ETF

Position 8: AI Champions DD

ARKK - ARK Innovation ETF

Position 9: Canopy HYCC Income

GLDI - UBS ETRACS Gold Shares Covered Call ETN

Position 10: Canopy DIVFUND Rotation

IDV - iShares International Select Dividnd ETF

Position 11: Strategy of Strategies (SOS): Canopy Gold’n Bonds

(NEW) IHYF -

Invesco High-Yield Bond Factor ETF

Position 12: Canopy Defensive HOLDING Core

USMV - iShares MSCI Min Vol Factor ETF

BRK.B - Berkshire Hathaway Inc. New Common Stock

SPHD - Invesco S&P 500 High Dividend Low Volatility ETF

-

Position 1: EZ-RO Sector Rotation Index ETF

EZRO - AlphaDroid Defensive Sector Rotation ETF

*internal trades and rebalancing within EZRO is done at fund manager level

Position 2: Canopy HYCC Income

GLDI - UBS ETRACS Gold Shares Covered Call ETN

Position 3: Canopy DIVFUND Rotation

IDV - iShares International Select Dividnd ETF

Position 4: Strategy of Strategies (SOS): Canopy Gold’n Bonds

(NEW) IHYF - Invesco High-Yield Bond Factor ETF

Position 5: Canopy Defensive HOLDING Core

USMV - iShares MSCI Min Vol Factor ETF

BRK.B - Berkshire Hathaway Inc. New Common Stock

SPHD - Invesco S&P 500 High Dividend Low Volatility ETF

-

Position 1: Canopy STOCKS (Top 12 Sector Stocks)

Healthcare: CVS - CVS Health Corp

Consumer Staples: EL - Estee Lauder-A

Consumer Discretionary: TSLA - Tesla Inc

Finance: (NEW) GS - Goldman Sachs Group

Industrial: JCI - Johnson Controls International PLC

Energy: (NEW) SU - Suncor Energy

Communications: GOOGL - Alphabet Inc Class A

Real Estate: WELL - Welltower

Technology: AMAT - Applied Materials

Utilities: XEL - Xcel Energy

Materials: ALB - Albemarle

Biotechnology: (NEW) ILMN - Illumina

Position 2: Global Prudence DD

(NEW) EEM - iShares MSCI Emerging Markets ETF

Position 3: Sectors Aggressive DD

(NEW) ITA - iShares US Aerospace & Defense ETF

Position 4: Strategy of Strategies (SOS): Canopy Sector Strike ETF

XPH - SPDR S&P Pharmaceuticals ETF

Position 5: Strategy of Strategies (SOS): Canopy Stylebox

(NEW) AOR - iShares Core Growth Allocation ETF

Position 6: Strategy of Strategies (SOS): Canopy Worldwide-Wide

(NEW) IXJ - iShares Global Healthcare ETF

Position 7: Canopy Crypto

(NEW) RIOT - Riot Blockchain

Position 8: Canopy Momentum Selector

(NEW) MU - Micron Technology

-

*Positions 1-3 may employ LEVERAGED stock/ETF holdings

*Expect HIGH daily volatility

Position 1: KRG B3

PILL - Direxion Daily Pharmactl&Med 3X Bull ETF

Position 2: BTC Accelerator

OPEN - Opendoor Technologies

Position 3: Play 13 15

PILL - Direxion Daily Pharmactl&Med 3X Bull ETF

Position 4: Canopy Momentum Selector 1

(NEW) MU - Micron Technology

Position 5: Canopy Momentum Selector 2

(NEW) IREN - Iris Energy Ltd

Position 6: Canopy Crypto

RIOT - RIOT Blockchain

Position 7: Running With Them Bulls DD

TECL - Direxion Daily Technology Bull 3X ETF

Dual Defense Portfolio Strategies

-

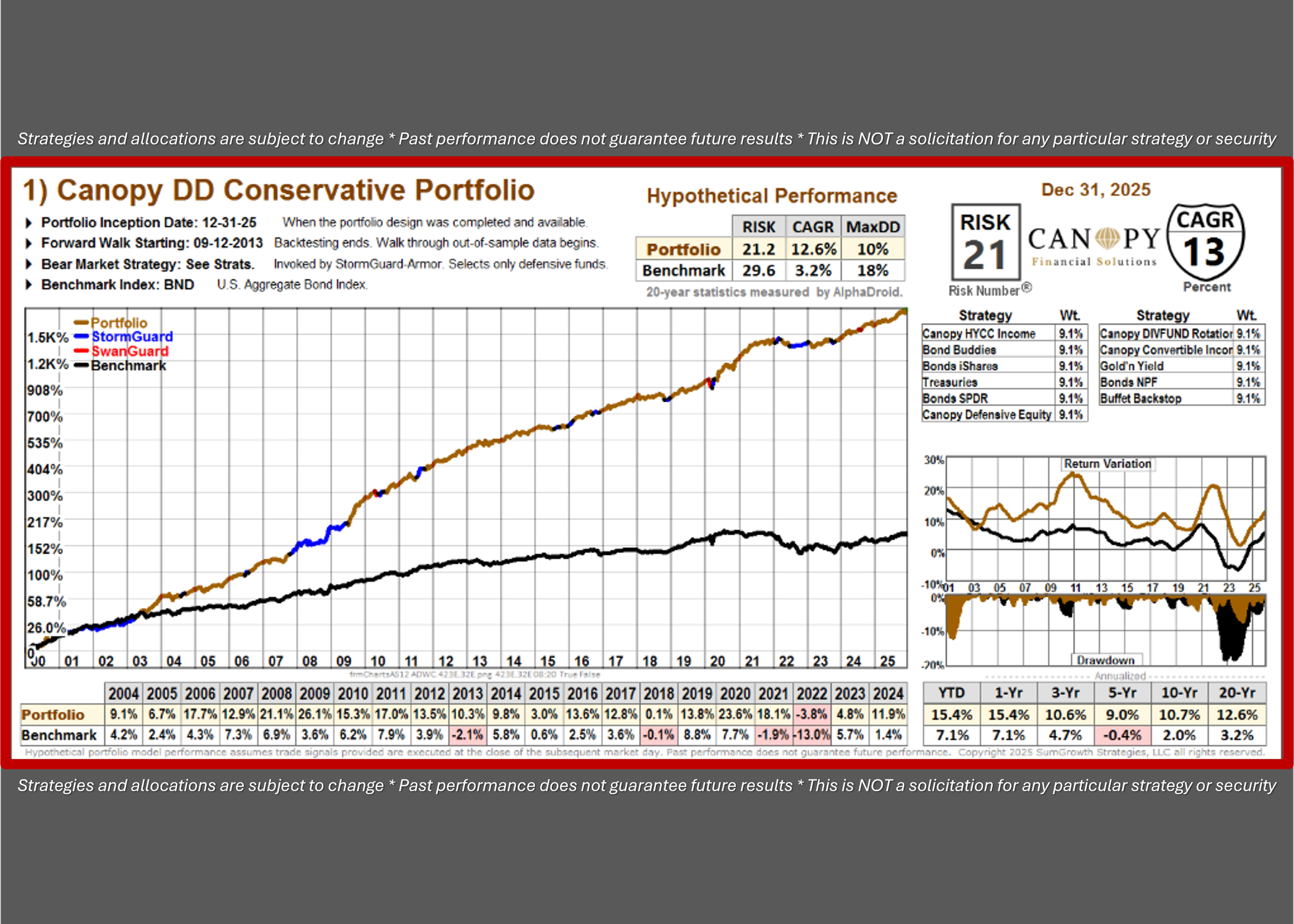

1. Canopy Dual Defense CONSERVATIVE Fund

Who’s It For?

Designed for conservative investors who require a fixed income that maintains pace with inflation but still has ability to appreciate and provide positive returns and Alpha against the US Aggregate Bond Index.

A low risk tolerance and aversion to volatility typically means that double-digit returns are out of the question — not here and not with Dual Defense strategies and technology.

What’s In It?

Composed of carefully chosen bond funds, hedged equity funds, preferred and convertible securities, and broadly diversified dividend funds.

-

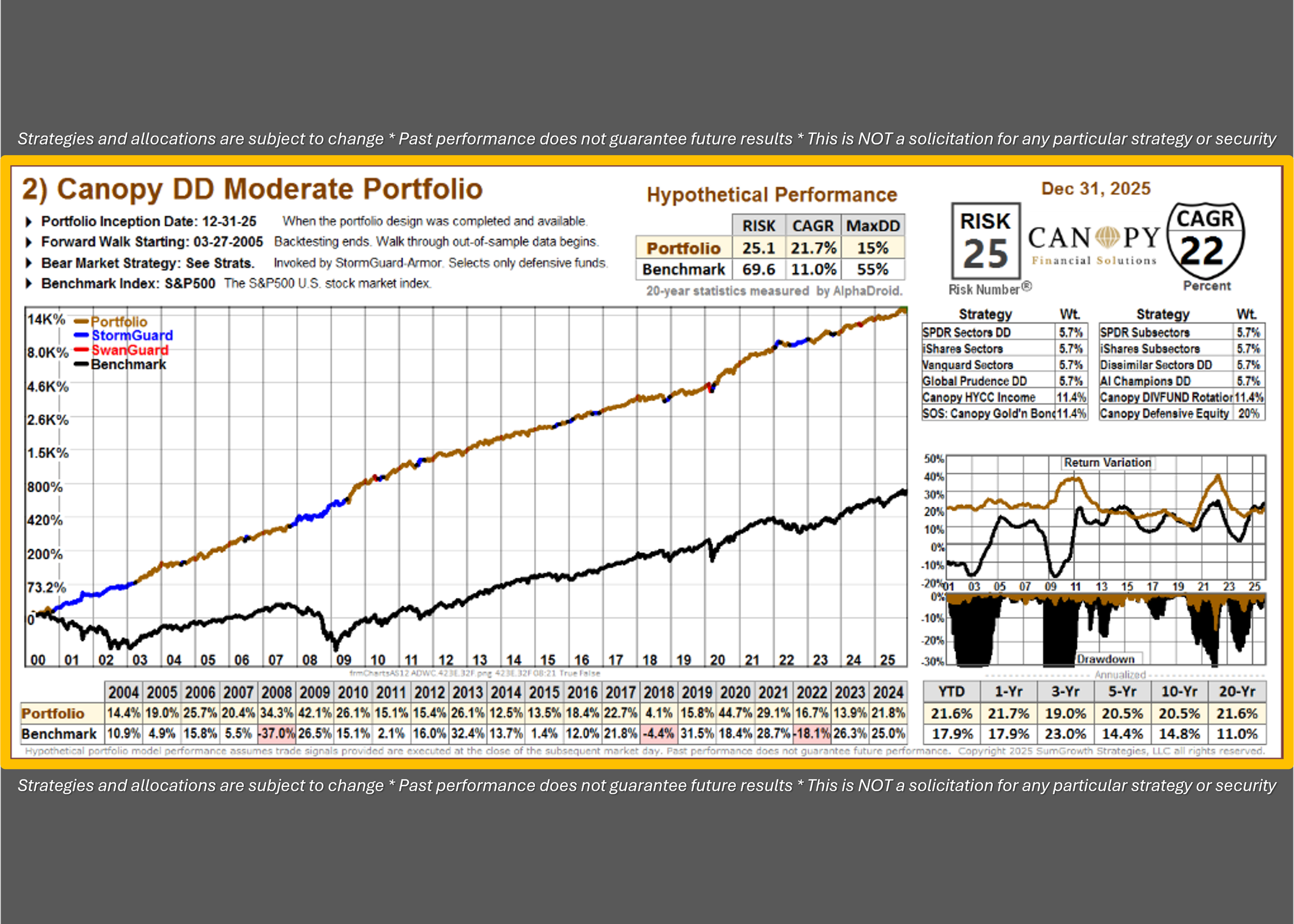

2. Canopy Dual Defense MODERATE Fund*

Who’s It For?

Moderate risk investors seeking market-beating potential with less volatility than our flagship Canopy Growth Fund.

What’s In It?

Majority weight to the eight EZ-RO index holdings - a carefully chosen collection of momentum leaders in various sector / sub-sector equity funds; minority positions are rounded out with hedged equity and defensive holdings.

*Nonqualified accounts subs EZRO ETF for the eight EZ-RO index holdings (equal weight) to reduce tax implications caused by tactical trading

-

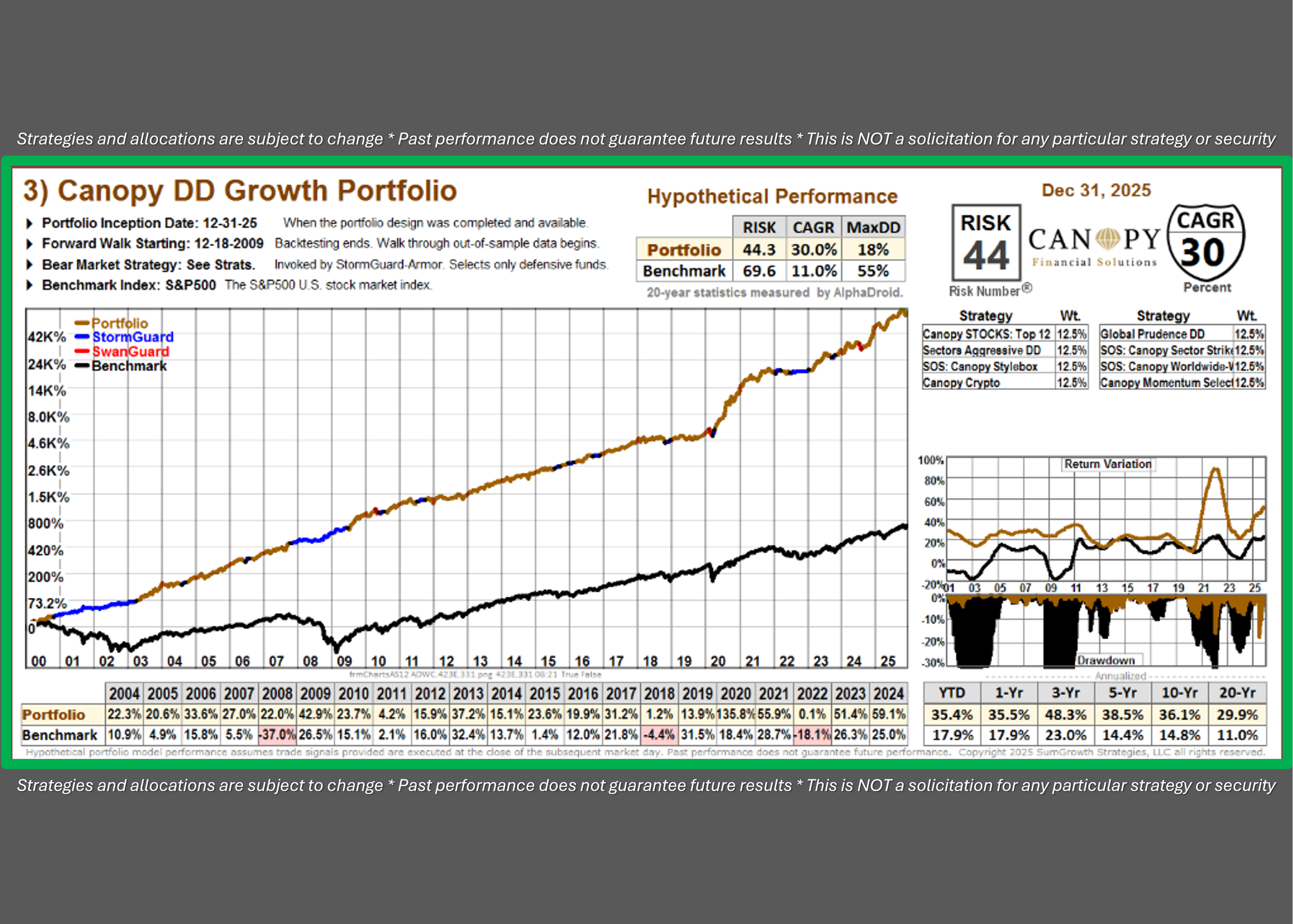

3. Canopy Dual Defense Standard GROWTH Fund

Who’s It For?

This flagship fund is designed for growth-oriented investors with 5+ year investment horizon. Like many other strategies it implements our Dual Defense approach to own momentum leaders in bull markets and employ alternative bear market strategies during prolonged downturns. This combination approach lends to the high Alpha potential.

What’s In It?

Composed of carefully chosen individual stocks that have been identified as momentum leaders in their respective sectors; also includes other factors, themes and styles for broad based and global growth potential.

-

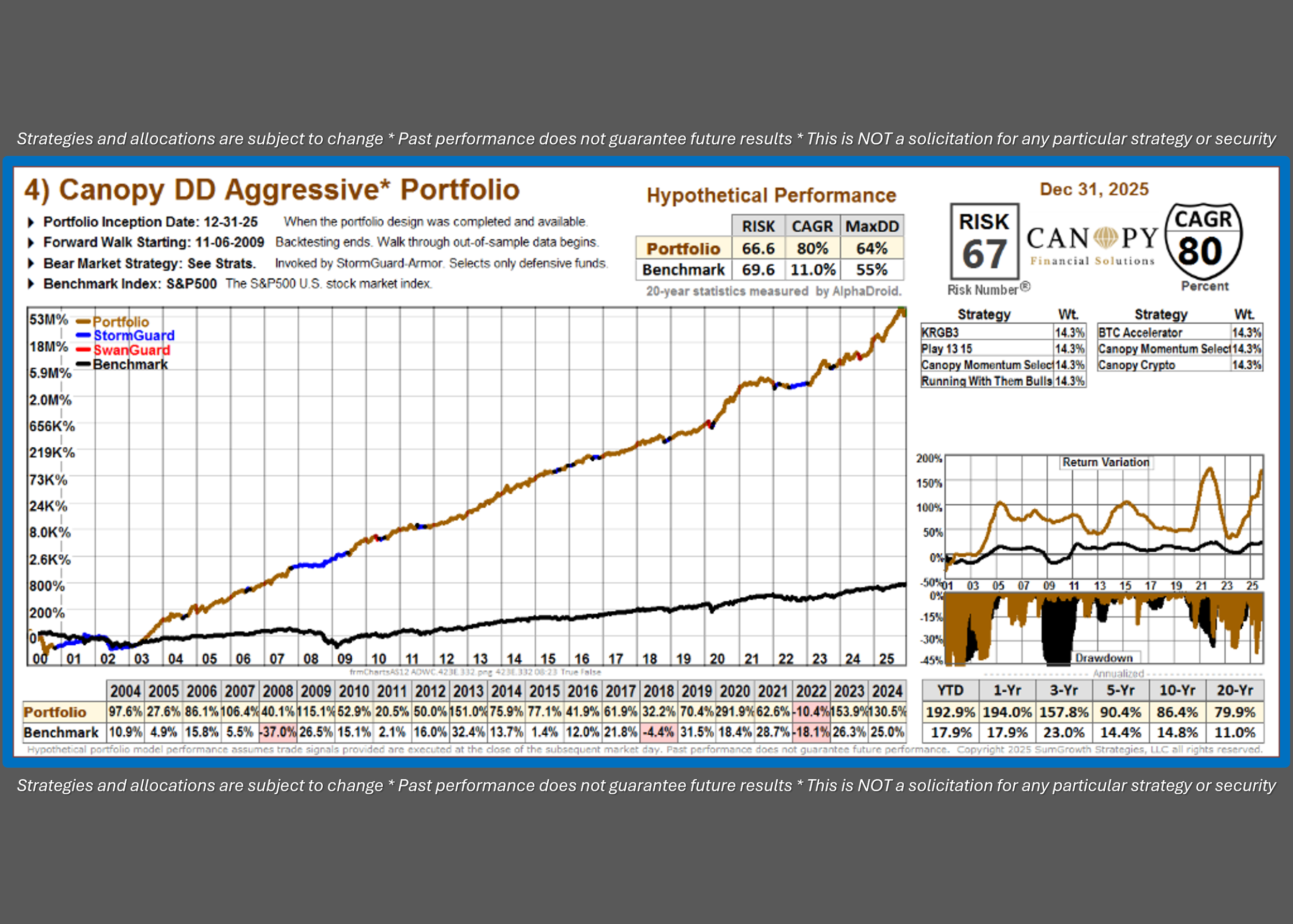

4. Canopy Dual Defense AGGRESSIVE* Fund

Who’s It For?

Only for ultra-aggressive investors with high risk tolerances seeking the ultimate risk-reward potential. Without the oversight of Dual Defense, understand that this portfolio could sustain catastrophic losses potentially exceeding 50% or more. *Expect extremely high daily volatility.

What’s In It?

Similar to the Canopy Standard Growth Fund, this portfolio implements a Dual Defense approach to identify the highest growth opportunities and trends using single stocks, 2-3x leveraged ETFs, thematic leaders and cryptocurrency funds. The Canop AGGRESSIVE Fund has Alpha-Crushing potential.